[ad_1]

This is part of Slate’s daily coverage of the intricacies and intrigues of the Sam Bankman-Fried trial, from the consequential to the absurd. Sign up for the Slatest to get our latest updates on the trial and the state of the tech industry—and the rest of the day’s top stories—and support our work when you join Slate Plus.

A big part of the story of FTX is that it rode an overall wave of enthusiasm for cryptocurrency in 2020 and 2021 to become one of the biggest players in the industry. But it also spent heavily on celebrity endorsements and campaign donations in order to attract more customers and gain political allies. The federal government alleges that the crypto exchange and its sister hedge fund, Alameda Research, accomplished this primarily by using money that customers had trusted that FTX would handle responsibly. On Monday, the prosecution in The United States v. Samuel Bankman-Fried offered a stunning, if incomplete, look into the FTX marketing and influence machines. The company and its execs spent fortunes that didn’t really belong to them—on athletes and comedians, on Republicans and Democrats—all to boost the crypto exchange.

Following testimony from a customer who lost money stored on FTX, the government brought in one of its key witnesses: Nishad Singh, a co-founder and the former director of engineering of FTX. Like earlier witnesses Gary Wang and Caroline Ellison, Singh was a core member of SBF’s inner circle. SBF watchers have long kept a close eye on Singh, not least because he was a resident of SBF’s infamous Bahamas penthouse, and because he’d pleaded guilty in February to charges of wire fraud, conspiracies to commit commodities and securities fraud, money laundering, and—perhaps most distinctively—campaign finance violations. He also, late in the game, got a close view of how much Sam Bankman-Fried’s companies were spending on celebrity endorsers.

Singh and Bankman-Fried go way back. They both attended the Bay Area’s prestigious Crystal Springs Uplands School, though Singh only became close with the defendant after befriending his younger sibling, Gabriel Bankman-Fried (more on him soon). Thanks to that connection, Singh went to work at Alameda Research and helped to code the nascent firm’s trading systems. Two years later, Singh would create the architecture for FTX’s customer trading platforms as Wang and SBF got the new business off the ground. Even though all three played instrumental roles in launching FTX to the stratosphere, as Singh related on the stand, their roles were never equal: SBF never coded himself, but he gave orders to Wang regarding FTX’s coding changes and functions; in turn, Wang “supervised me on every technical situation,” Singh said. In 2020, while FTX ballooned, Singh began managing other software engineers and building a dedicated team, yet his position among FTX’s founding fathers was unusual. For one, after leaving Alameda in 2019 to get FTX going, he still technically worked for Alameda until “sometime in early or mid-2020,” after which he formally ceded his position at the hedge fund. Singh also had a smaller stake in FTX than SBF and Wang, holding only 6 percent of company equity as compared with the latter’s 16 percent (though even this single-digit percentage technically made him a “billionaire”). And Singh was roped into SBF tasks that Wang didn’t seem to have much involvement in, such as the CEO’s desired startup investments as well as his transmission of political donations and endorsements.

Because of Singh’s work—both voluntary and somewhat involuntary, he’d explain—in those spheres, his courtroom interactions with the government were accompanied by a gallery of spreadsheets, text documents, and social media screenshots that conveyed the mind-boggling details of SBF’s high-power relationships. This was the week that the government moved beyond broadcasting FTX commercials with Tom Brady and Larry David, beyond displaying photos of Bankman-Fried hanging out with Tony Blair and Bill Clinton, and actually began laying out the particulars of those encounters. Which, as the assistant U.S. attorneys are arguing, were an important step in SBF’s scheme to get users to trust that he wouldn’t do the things he allegedly ended up doing—i.e., collecting billions of dollars of customers’ deposits without their express consent.

The jumping-off point was the investment firm K5 Global, an entity you may recall from the recordings of Caroline Ellison’s confessional all-hands meeting with Alameda staff in the midst of company collapse. In that context, K5 Global was mentioned as one of the many companies that received hefty payments from Alameda using FTX customer funds—in this case, about $300 million that was wired over in March 2022. You may also remember K5 making public waves this summer, when the bankruptcy experts overseeing the recovery of FTX and Alameda’s lost billions sued K5 and its leaders, Michael Kives and Bryan Baum, to claw back $700 million. (Two additional $200 million disbursements were sent in May and September 2022 at Bankman-Fried’s behest, as Fortune Crypto’s Ben Weiss documented in June; Kives and Baum pocketed a nice $125 million each.)

All of that is less important, though, than what K5 and its execs represented to SBF. As was revealed in a document dated Feb. 15, 2022, SBF really wanted to cultivate a relationship with Kives in particular because “he is, probably, the most connected person I’ve ever met.” How did he know this? Because just days beforehand, SBF had twice hung out with Kives—for a dinner at his Los Angeles residence, and at the dang Super Bowl. (Yes, the same Super Bowl during which those lovely FTX ads aired on TV, setting up their celebrity sponsors for future lawsuits.) At the time, Bankman-Fried wrote, Kives was vacationing with Katy Perry, Orlando Bloom, and Kate Hudson; they’d been guests at the L.A. dinner along with Doug Emhoff, Leonardo DiCaprio, Jeff Bezos, Ted Sarandos, Kendall and Kris Jenner, and Corey Gamble. (“I honestly could not tell you what [the Jenners] do,” said Singh, inviting some laughs from the courtroom.) SBF likewise mentioned that Hillary and Bill Clinton had spoken at Kives’ wedding, and included a link to a Hollywood Reporter dispatch from the K5 head’s 2018 marriage ceremony. Curiously, Bankman-Fried did not mention that Kives entered the Clintons’ circle at Stanford University (yes, that’s where SBF’s parents taught), after covering Chelsea’s 2001 graduation from the school for the student paper. From there, Kives landed a gig working with Huma Abedin for Sen. Hillary Clinton, after which he spent 15 years rising through the ranks at Creative Artists Agency and representing everyone from Perry to Mikhail Gorbachev. He then left that career to start K5 Global in 2018; startup funder Bryan Baum joined the company in 2020.

So yeah, Kives was quite connected, and Bankman-Fried noted that “he’s been very friendly to us, and already started to create valuable relationships,” linking to an Instagram post from Katy Perry captioned, “im quitting music and becoming an intern for @ftx_official ok 👋🏻.” (That same post was linked later in the doc as an example of a “potential unpaid partnership with celebrities.”) Per the bankruptcy suit, SBF first corresponded with Kives on Nov. 16, 2021, when the latter introduced the crypto titan to the pop artist Sia, soon after which “Kives began inviting Bankman-Fried to dinner parties with Wall Street titans, Academy Award–winning actors, and NBA stars.” All that led to SBF being included in Kives’ Super Bowl posse, a photo from which fellow attendee Katy Perry later posted to Instagram—and which came up as evidence in the courtroom, where the prosecution asked Singh to identify the people in the football stands. Though he didn’t go through all eight people in the group, Singh did pick out the key players: Perry, Bloom, Kives, and SBF.

Essentially, SBF wanted to make the case for investing in and establishing a tight relationship with K5 Global because FTX could benefit from Kives’ “essentially infinite connections” to get “potential endorsement deals” and “political connections,” among other things. (“I think that if we asked them to arrange a dinner with us, Elon, Obama, Rihanna, and Zuckerberg in a month, they would probably succeed,” SBF had also written.) In turn, K5 wanted FTX to guide the firm through the crypto industry, to “work with them on Democratic politics,” and potentially “to invest in them or some stuff, idk.” Considering the eventual deal pledged up to $3 billion for K5, that’s gotta be the priciest “idk” I’ve ever seen—and yes, Singh was asked to explain the meaning of “idk” on the stand.

With friends like Kives, SBF was primed to keep making the types of lofty payments and partnerships that were detailed in a separate piece of evidence: a “Master List” of FTX sponsorships from 2021, which included several entries extending beyond the already well-known (and now nullified) deals with the Miami Heat, FTX Arena, Kevin O’Leary, and the esports team TSM. According to the document, FTX agreed to sponsor the League of Legends Championship Series for $99.8 million over a span of seven years. It had promised $148 million to Major League Baseball for a five-and-a-half-year deal that would include both “sponsorship” and “cryptocurrency integration.” It had three-year contracts with Steph Curry where it would pay the basketball star $28.5 million, along with another $1.5 million to the charity bearing his name. It agreed to pay $5 million to Barstool for some football-related branding. Japanese baseball wonder Shohei Ohtani would get $11 million for five years of shilling. To Coachella, $25 million over three years. For the International Cricket Council, $19.5 million over two years. Hey, there’s Larry David, who got $10 million! And there’s all-time chess great Magnus Carlsen, who netted $3.25 million for sponsorships during international chess tourneys like the FTX Crypto Cup. (As it happens, I asked Carlsen about that sponsorship deal before FTX fell.)

Singh, for his part, did not feel good about this marketing. “I mostly learned about them after the fact and certainly learned about the amounts after the fact,” he told the court, explaining that he saw the master list for the first time in late 2022 when FTX’s head of finance, Jayesh Peswani, showed him the eyebrow-raising figures as part of an inquiry into FTX’s user growth. Singh also expressed doubts about K5 when the prospect of working with Kives was raised earlier in the year. “I was worried that partnering with K5 and giving them this much money would be really toxic to FTX and Alameda culture,” he related to the jury. “Every day I was actively trying to espouse—I felt we all were—that politicking and social climbing was not going to be rewarded, and here we were rewarding people in exorbitant amounts.” (Although, as the defense pointed out Tuesday, Singh clearly wasn’t so concerned as to turn down a bedroom in the $35 million Bahamian penthouse.) From this answer it would appear that Singh, at least privately, was more devoted to the “earn-to-give” altruism that supposedly guided Bankman-Fried than Bankman-Fried himself was. Singh also told the court that he’d relayed his concerns about K5 to SBF after the CEO sent him and Gary Wang “a term sheet of Google Docs” that “laid out hundreds of millions of dollars of bonuses to Michael Kives and Bryan Baum, and proposed up to a billion dollars, long term, of capital to give to” K5 Global. He’d also asked SBF if the company could “go back” on the K5 arrangement, only for him to respond that it was “basically done.”

Now, the political stuff.

Singh made political donations allegedly on behalf of Sam Bankman-Fried, according to some of the juiciest parts of Monday’s testimony. SBF is not facing campaign finance charges in this trial; thanks to various legal knots in his extradition to the United States from the Bahamas, he’ll be contesting those allegations in March. Judge Lewis A. Kaplan made that fact clear early in Singh’s appearance, emerging after a sidebar with attorneys to “remind [the jury] that, as I said earlier in the trial, the defendant is not charged with any criminal violation of campaign finance laws in this case. This evidence is coming in for other purposes, not least of which would be the fact that this witness has pleaded guilty to such a violation.” Still, this stuff was fascinating.

Another government exhibit laid out an elaborate spreadsheet that tracked political donations and charitable gifts made from SBF, FTX’s U.S. branch, Singh, Ellison, and “RDS,” whom we can safely assume to be FTX exec Ryan D. Salame. Throughout mid-to-late 2021—notably, before he first linked up with Kives—SBF donated about $5,800 each to six congressional Democrats: Sens. Alex Padilla, Joe Manchin, Patty Murray, and John Hickenlooper (with another $5k for his Hickenlooper Leadership PAC) along with Reps. Peter Aguilar and Hakeem Jeffries. Other Dems received varying amounts: $2,900 each for Reps. Julia Brownley, Raul Ruiz, Tony Cardenas, and Jim Himes; $5,700 for New Jersey Sen. Cory Booker, who later praised SBF’s “Afro”; and $20,800 for New Hampshire Sen. Maggie Hassan. There were a few Republicans in the mix, too, with $5,800 each going to Sens. Susan Collins, Mitt Romney, Ben Sasse, Bill Cassidy, Lisa Murkowski, and Richard Burr.

The donations really rocketed up in 2022, which my colleagues Ben Mathis-Lilley and Alexander Sammon have chronicled in detail, so let me just pull out this interesting data point: In August, SBF donated a whopping $10 million to One Nation, the dark-money nonprofit aligned with Mitch McConnell. The only other entities that received more in total donations were orgs primarily run and managed by either Sam or his brother, Gabe Bankman-Fried, including Guarding Against Pandemics, Protect Our Future, and Building a Stronger Future. (Huh!) Similarly, all of FTX.US’s donations to political organizations went to groups that threw cash at major Republicans such as Kevin McCarthy (Congressional Leadership PAC), Patrick McHenry (American Patriots PAC), Joni Ernst (the Bastion Institute), and John Boozman (Heartland Resurgence Fund). One of those Republicans, incidentally, included Salame’s romantic partner, the failed Long Island congressional candidate Michelle Bond, who got a nice $200,000 from the GMI PAC (to which SBF donated $2 million in January 2022, per the donations spreadsheet).

As for the donations in Singh’s name? Turns out, Singh testified, “There were political donations made in my name … through my bank account, funds deposited straight from Alameda,” which consisted of FTX customer funds and/or bits of Singh’s own FTX-linked money (salary, personal FTX account). His personal “involvement” in ordering those donations was “very, very minimal,” Singh mentioned, elaborating that this process churned through a Signal group chat formed in March 2022 called “Donations Processing.” This forum included, among others, SBF, Singh, Ellison, Gabe Bankman-Fried, and a couple of the younger Bankman-Fried’s associates: Michael Sadowsky, who’d worked with Gabe at Civis Analytics and went on to kickstart the aforementioned Protect Our Future PAC, as well as Keenan Lantz, who became an executive for Gabe’s Guarding Against Pandemics nonprofit. In that group chat, Singh expounded, any of these folks “would request that a donation be made in my name.” Then “Ryan Salame, who had access to my bank account, would transfer money out of my bank account for that purpose.”

An October screenshot from “Donations Processing,” published to the jury, showed Lantz specifically asking Salame if $20,000 could be sent in Singh’s name to the Delaware Democratic Party, and Salame informing Singh that the donation was “queued up” so that Singh could digitally sign off on it. (Singh told the prosecution he was “not at all” involved with the decision to splurge on Delaware’s Dems.) Another one requested in Singh’s name encompassed $107,000 to the New York State Democratic Committee, although this one didn’t seem so urgent, per a message from Salame: “if [Gov. Kathy Hochul] does loose we have an A+ relationship with zledin haha,” referring to GOP gubernatorial candidate Lee Zeldin. Singh’s “donations” as laid out in the spreadsheet consisted not just of “political” contributions (whose recipients included Gabe Bankman-Fried himself as well as Mind the Gap, the PAC started by his mother), but also “gifts” to myriad figures and organizations in the effective altruism and longtermism movements, like the Future of Life Institute and the A.I. startup Anthropic. To tangle it all into one incestuous knot: A “political gift” of $19,144 was granted under Singh’s name to effective altruist writer Avital Balwit—who herself appears to have been a member of the “Donations Processing” group. (She is currently a communications lead for Anthropic.)

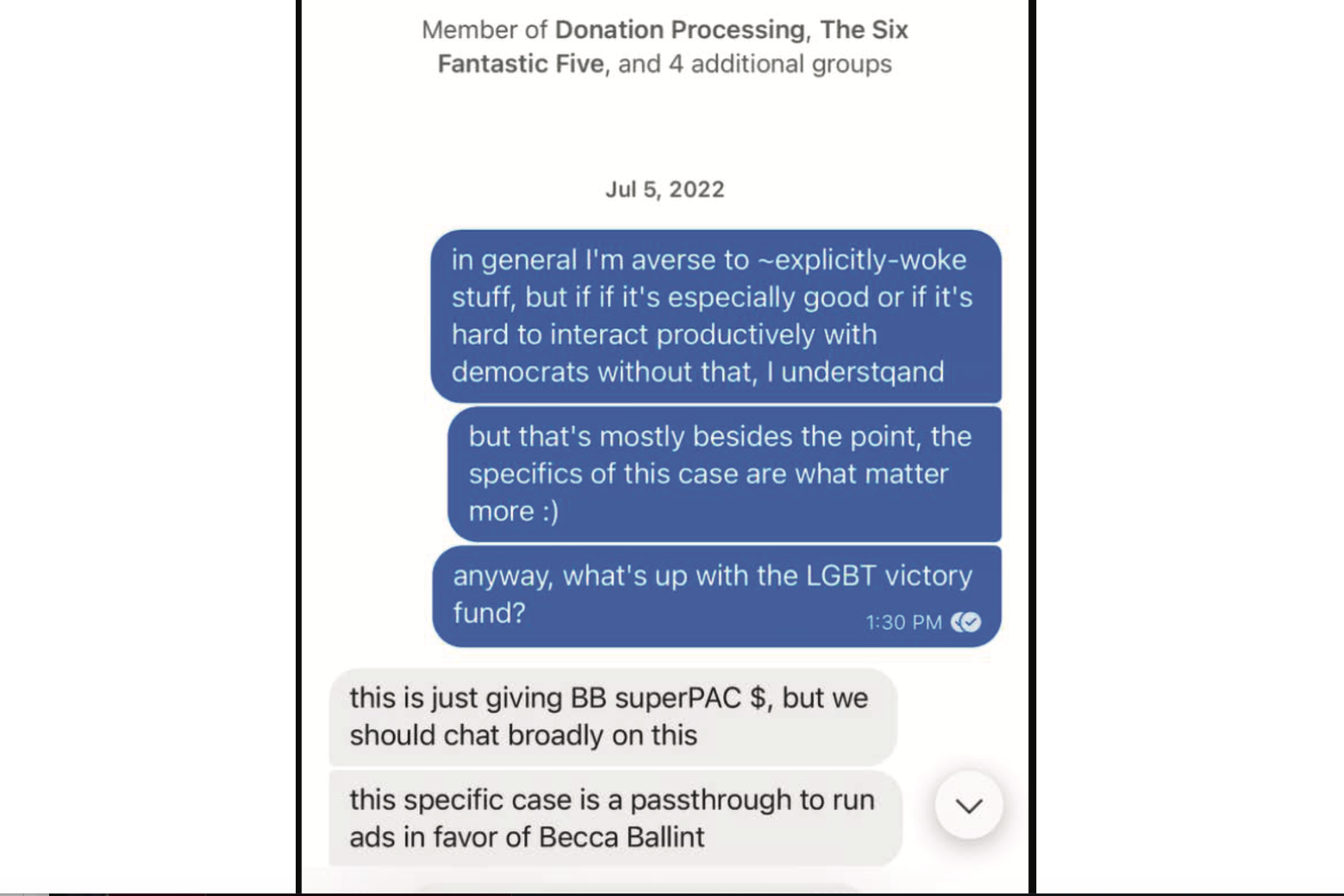

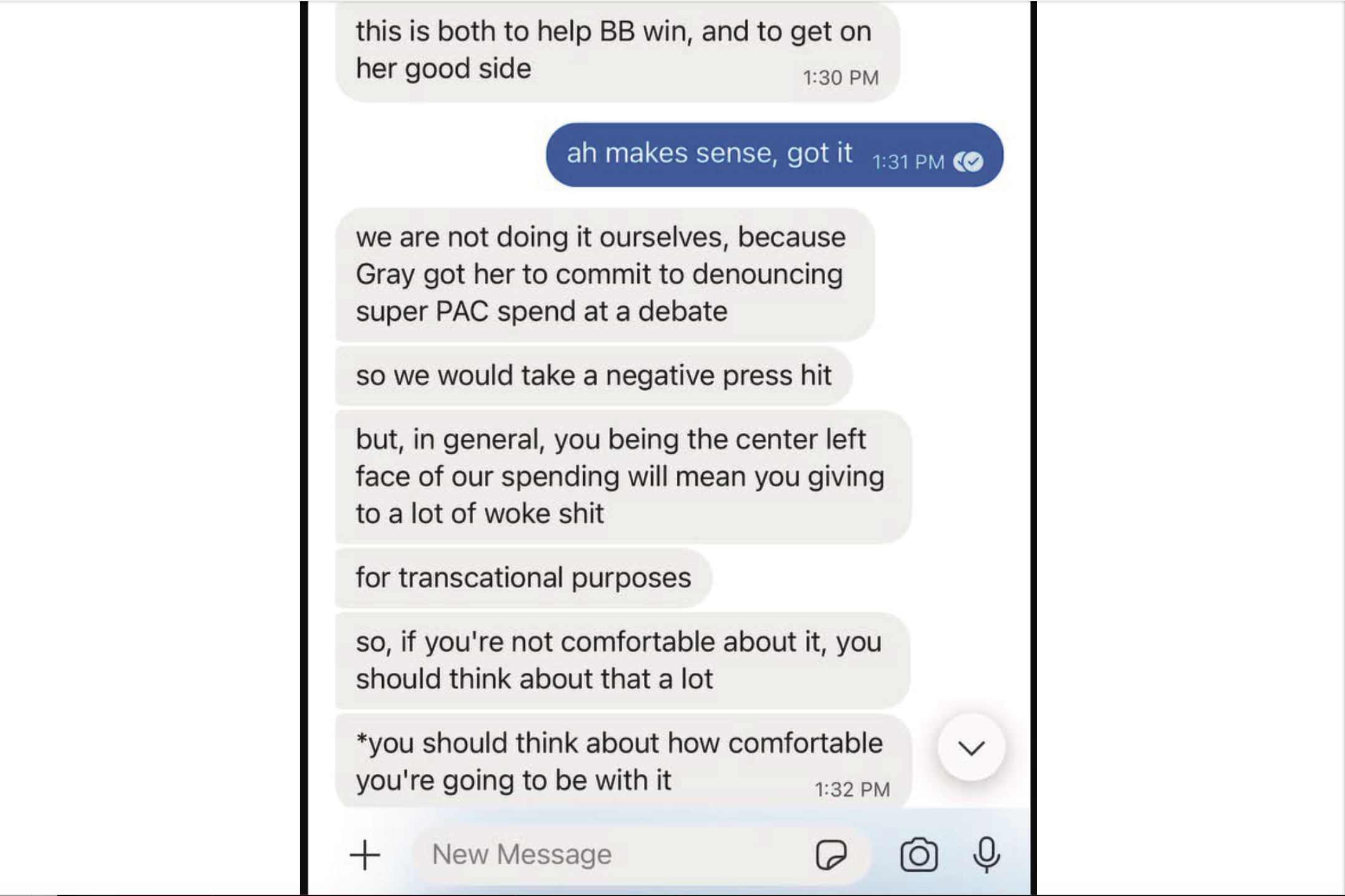

Signal

Signal

What about when Singh did weigh in on donation recommendations? A separate Signal chat showcased to the jury displayed Singh corresponding with Sadowsky on July 5, 2022, over a potential donation in Singh’s name to the LGBTQ+ Victory Fund—the same chat where Sadowsky infamously referred to Singh as “the center left face of our spending,” meaning that Singh would appear to be “giving to a lot of woke shit. For transactional purposes.” Singh testified, “On its face a donation may appear to be for one purpose, say, going to a PAC called the LGBTQ+ Victory Fund. But, in reality, the true purpose is something else, and it may be the funds end up affecting some outcome that seems unrelated to LGBTQ efforts.” The chat indeed seemed to provide an example, with the fund donation appearing to be “a passthrough to run ads in favor of” Becca Balint, a Democrat who was elected in the midterms to represent Vermont’s at-large congressional district. “This is both to help [Balint] win, and to get on her good side,” Sadowsky expounded—which would be advantageous if she, say, eventually became one of Vermont’s senators, the consultant added.

Anyway, “for the donations that were made in your name in the fall of 2022 that were funded with wires from Alameda, from where did you understand the money was coming from?” Assistant U.S. Attorney Nicolas Roos asked Nishad Singh. Quoth the witness: “Customers.”

[ad_2]

Source link